Top Beverage Trends for 2023

Viral specialty cocktails, celebrity spirits, canned seltzers, conscious consumption: These trends and others have taken the beverage industry by storm during the last few years, evolving the market and impacting sales, consumer mindsets, and the future of alcohol.

This month, FORM industry advisors and Beer, Wine, and Spirits experts Cory Knopp and Tim Hamm attended the Beer, Wine, and Spirits Industry Summits, hosted by industry-leading publication BeerNet. The team picked up incredible insights into the future of the industry, giving sales teams an edge, and driving consumer demand—all while connecting with some of the biggest leaders in the market (and sharing a beer or two).

After the summit, FORM is feeling inspired and energized as we prepare for key trends in the beverage industry this year and beyond. Are you and your teams ready? Read on to learn some of our biggest takeaways from the summit with research from NielsenIQ, and how you can leverage these trends to stay ahead in the market this year.

More Mocktails on the Menu: The Rise of Non-Alcoholic Drinks

The idea of cutting back on alcohol consumption has been around for years, with some people trying their hand at “Sober October” or Dry January since the campaign began in 2013. Now, an estimated 38% of consumers are likely to participate in Dry January, and many of these will continue beyond the first month of the year.

Luckily for the sober-curious consumers in 2023, going alcohol-free is much easier than it was just a few years ago. Non-alcoholic beer, wine, and spirits saw $424 million in sales in 2022—up 21.5% from the previous year. This is due to new no- and low-alcoholic beverages flooding the market. Dry January participants no longer have to choose between tonic water and soda when out with friends, but can enjoy a wide selection of booze-free wines, beers, and cocktails.

Demand for non-alcoholic drinks has exploded in the last few years as many consumers are becoming more mindful about what, and how much, they consume. This movement is growing in popularity and is primarily driven by young people, with 45% of Gen Zers over 21 reporting that they never consume alcohol. However, for the sober-curious segment, Gen Z or otherwise, NielsenIQ found that 4 out of 5 buyers of non-alcoholic beverages also purchase beer, wine, and spirits with alcohol. This means that there are opportunities for Beer, Wine, and Spirits brands to cater to consumers while still driving sales in traditional products.

Cory Knopp, FORM’s VP of Sales, shares, “As the demand for NA beverages continues to expand, this presents opportunities AND risks for brands and distributors. In the months ahead, teams should look for ways to capitalize and expand their portfolios in off-premise accounts and look for ways to protect their position in on-premise accounts.”

The Impact of Inflation on the Beverage Alcohol Industry

The trend of premiumization has been going on for a while, and despite inflation and the state of the economy, consumers are willing to spend more for premium beer, wine, and spirits. Premiumization has also been heavily impacted by the blurred lines between on-premise and off-premise consumption in a post-COVID world. As more people are becoming at-home mixologists, they are willing to spend more on the products that will allow them to recreate the on-premise experience in their own homes. Most of these premium products are spirits, with 33% of Americans reporting to have spent over $50 on a single bottle of alcohol in 2022.

“Even though many Gen Zers aren’t drinking alcohol,” says Tim Hamm, Market Director for Beer, Wine, and Spirits and former VP of On-Premise Spirits for Republic National Distributing Company, “those who are are drinking high-end drinks. This group came of age during the premiumization trend and it’s normal for them to drink fancy and expensive cocktails.”

Consumers’ spirit of choice is changing, too. In 2022, tequila overtook whiskey to become the second more valuable subcategory in the U.S. and is set to surpass vodka in 2023 to claim the position of industry leader.

For suppliers and distributors, the desire for premium products and home bars brings a unique opportunity to drive sales by including and marketing high-end, quality products in their portfolio. But as inflation doesn’t appear to be going away any time soon, brands still need to prepare to combat rising prices. Check out FORM’s Pricing Playbook to see how automated pricing detection allows teams to gain insights, increase efficiency, and drive profitability in an inflationary environment.

COVID is Still Shifting Trends

Three years after the pandemic, we’re still seeing its impacts in many ways, especially in the hospitality and beverage industries. As more people are now permanently working from home, bars, restaurants, and suppliers are accommodating to this lifestyle by offering meal delivery, to-go alcoholic beverages, and even online alcohol sales (which are predicted to grow by 34% in the next three years).

This new landscape has completely shifted the channel breakdown between on-premise (bars, restaurants, and other venues) and off-premise (alcohol, convenience, and grocery stores) sales.

It’s doubtful that the on-premise landscape will return to pre-Covid levels, at least not for several years, which will force the industry to adapt to a more hybrid approach to managing operations and execution.

Ready-to-Drink is Ready to Grow

A few summers ago, hard seltzers were just beginning to sweep the nation, and when the pandemic hit, they were officially the drink of choice for nearly everyone from college “bros” to health-conscious women and even those who are keto and gluten-free. According to NielsenIQ, hard seltzer off-premise sales hit $4.1 billion in 2020, up 160% from the previous year, with industry giants White Claw and Truly making up 75% market share combined.

However, due to an oversaturated market, emerging products, and shifting consumer behaviors, it seems Americans’ seltzer craze is coming to a close, as off-premise sales of canned beverages dropped for the first time since 2020. Now, new products are growing in popularity, with RTD spirit-based cocktail sales increasing by 68% in off-premise channels and RTD wine growing by 29%. These drinks offer consumers variety, convenience, and flavor in a cheaper (and often lower-calorie) way than on-premise cocktails and wines, and are expected to continue growing throughout this year.

How Suppliers and Distributors Can Keep Up in 2023

As consumers’ lifestyles, finances, and preferences are always evolving, it’s up to brands to serve these needs by leveraging a relevant and strategic go-to-market approach. New categories, new channels, and new growth drivers are key trends to keep in mind this year as brands position their products in-store and on-premise.

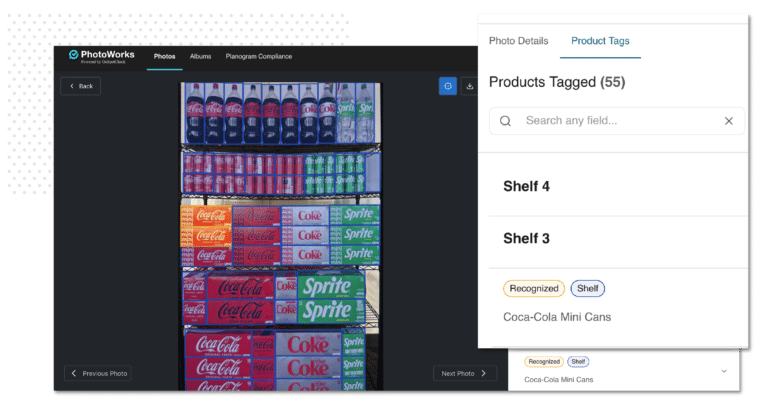

But trends change quickly, and teams need to stay agile to respond to market changes in real time. By using the latest tools and technologies, teams can survey accounts, confirm execution, analyze category share and out-of-stocks, and track how their products are performing against competitors. Receiving a full view of positioning and execution can not only allow teams to make smarter decisions and keep up with trends in real time, but to also increase efficiency and drive sales.

Image Recognition by FORM is the world’s only task management app powered by computer vision. Use our product detection AI to gain insights into execution, save time, and boost category share. Explore more about FORM’s Image Recognition technology, including market reports and interactive product tours, here!